Use the finest CFD brokers in the UK to steer the markets. Access to a limited pool of well-informed and dependable brokers who are committed to helping you navigate the intricacies of CFD trading is made potential by our platform. You can accurately and confidently navigate the erratic markets with their assistance and limited knowledge. Our brokers provide wise analysis, market insights, and strategic advice to help you reach your financial purposes, despite of your level of experience with trading. Put your confidence in our excellent CFD brokers to help you succeed in the powerful world of online trading.

Within the UK’s successful financial scene, CFD (Contract for Difference) trading is a well-liked choice for investors who desire to profit from market variability. It can be obstacle to choose the best Cfd Brokers Uk because there are various of them fighting for business. Traders with discernment, though, know how important it is to partner with dependable CFD brokers who provide dependability, transparency, and an comprehensive array of trading tools.

For those looking to gather subjection to the foreign exchange markets, forex CFD trading is a highly sought-after choice. With the correct CFD broker, traders can access a broad range of currency pairs and influence their positions to enhance their gains. This dynamic and liquid market offers plenty of profit resources.

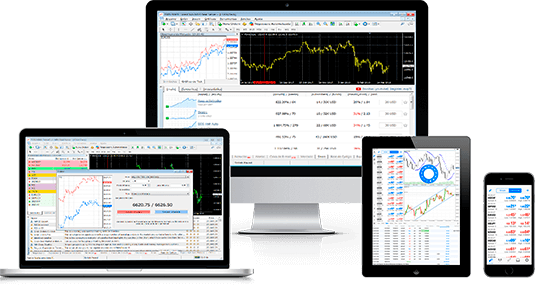

The Metatrader 5 platform, which is broadly trusted by traders worldwide, is the foundation of trade Forex CFD. It is a stable and adaptable trading stage. With customisable indicators, automated trading features, and complexity charting tools, Metatrader 5 enables traders to effectively and precisely implement their Forex CFD strategies. In addition, users can be guaranteed a perfect trading experience by the Metatrader 5 platform, which is well-known for its stability and security.

Installing the stage is the first easy step for anyone interested in using Metatrader 5 to examine Forex CFD trading. Traders can now install Metatrader 5 on their PCs and get instant market access thanks to its free download feature. Trading Forex and CFDs from the comfort of home is potential for traders who want to take benefit of Metatrader 5’s power with a some clicks. With unpaired flexibility and convenience, the MT5 download for PC offers traders a world of potentials.

As a result of offering traders the direction, increment, and tools they require for achievement, CFD brokers in the UK are necessary to the assistance of Forex CFD trading. Traders can fully realise their possible and take benefit of resources in the fast-paced world of Forex and CFD trading by utilising the Metatrader 5 platform, which is accessible for Metatrader 5 free download on PC. Despite of your level of experience, selecting the best CFD broker and utilising Metatrader 5’s capabilities can put you on the road to profitable trading.