Any type of trading was considered to be a difficult process. Contacting the broker, making contracts, opening an account, and then trading. The process before you even start Forex CFD trading, Gold CFD trading, or any sort of trading is very lengthy itself. Also, the risk of losing money due to misinformation was always there until online CFDs trading came in. It reduced the process of offline trading a lot, and anyone with an internet connection and the required documents could do trading with ease. Nowadays, there are a lot of stock trading platforms, each of which offers a different set of features, so choosing one platform for online stock exchange becomes difficult. But we have got a solution for you in this article, and it is the best UK CFD trading platform.

CWG

The online trading platform of CWG Markets helps you deal with various financial products like precious metals, crude oils, futures, etc. They provide excellent financial security and low brokerage costs. The use of various instruments helps the platform get the latest and most accurate market trends in real time. There are many reasons to choose CWG markets among other CFD trading brokers.

Best API Trading

Trading with APIs is a new trend in the online market. You don’t have to search for exchanges, data, and prices for each CFD, as this work will be done by the API. It is not only easier to get live market analytics, but it is also a way to get details on previous prices. APIs will get this information to you with high speed and efficiency. This stock trading API will help you connect and interact easily with the ecosystem of CWG Markets.

Stock Trading Account

The process for opening a stock trading account at CWG is very short. The first step is to click on the registration link on the website to start the process. Then, you will be made available with a form. This form asks for various details that will be needed to start CFD trading in the UK. Also, you will have to choose one of the three types of trading accounts at CWG. These are classic, advanced, and institutional accounts. Study these accounts before you make a decision and choose the one that suits you. Afterward, you can start trading with CWG Markets as your online stock broker.

There are many benefits to this stock trading account, like the fact that you can start trading a huge range of markets right after you open the account. This account will have access to 100s of markets globally, where you can trade Forex CFD with great reliability.

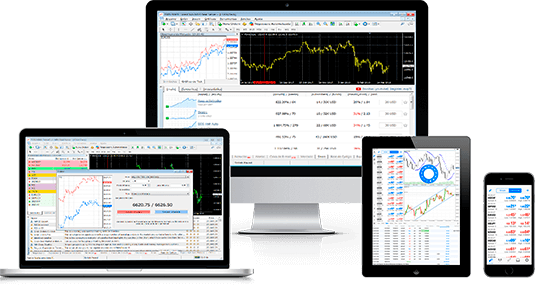

Multiple Platforms

You can access the power of the MetaTrader 5 platform with CWG. Although Mt5 Download for PC is available, you can even download the mobile app of CWG. This app is available for both Android and iOS. You can even trade on the go with the CWG mobile app.

Reaching the end of this article, it can be inferred why CWG is the best CFD trading platform and should be chosen before other stock trading platforms. To learn more about CWG stocks, visit them at cwgmarkets.co.uk.