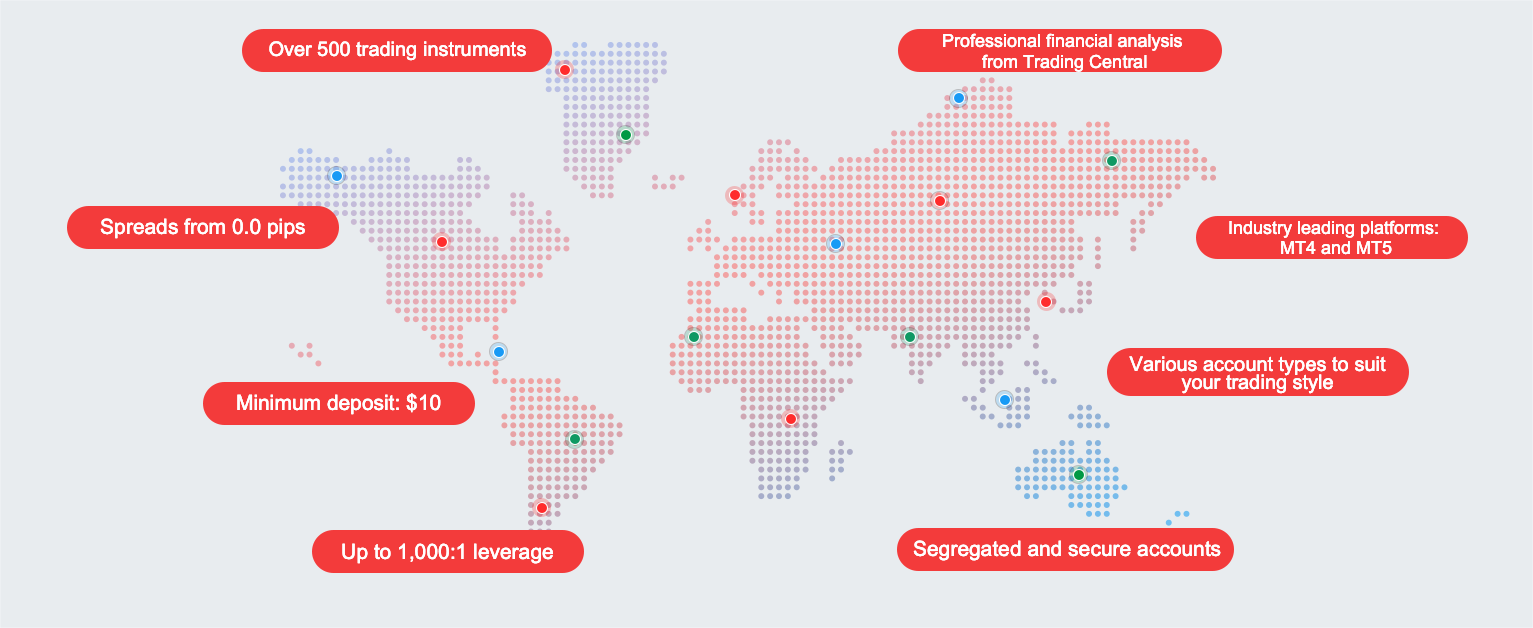

The CWG (Crypto, Forex, and Single Stock CFD Market) market is a fast-paced and ever-changing environment that can be both exciting and challenging for traders.

With so many factors at play, it’s important to have a solid strategy in place to navigate the market successfully. In this blog, we will share some tips to help you trade in the CWG market more effectively.

-

Stay Informed:

One of the most important things you can do as a trader is to stay informed about the latest news and developments in the market. This includes keeping an eye on market trends, economic indicators, and geopolitical events that can impact the market. By staying informed, you can make more informed trading decisions and stay ahead of the game.

-

Set Clear Goals:

Before you start trading in the CWG market, it’s essential to set clear and realistic goals for yourself. Determine how much money you want to make, how much risk you are willing to take, and how long you plan to hold onto your investments. By setting clear goals, you can better manage your trades and make more strategic decisions.

-

Diversify Your Portfolio:

Diversification is key to successful trading in the CWG market. By spreading your investments across different asset classes, sectors, and regions, you can reduce your risk and potentially increase your returns. Diversification can help you weather market volatility and protect your portfolio from unexpected events.

-

Use Technical Analysis:

Technical analysis is a powerful tool that can help you identify patterns and trends in the market. By using technical indicators such as moving averages, RSI, and MACD, you can better predict market movements and make more informed trading decisions. Technical analysis can help you spot entry and exit points and maximize your profits.

-

Manage Your Risk:

Risk management is crucial when trading in the CWG market. It’s essential to set stop-loss orders to limit your losses and protect your capital. Additionally, it’s important to diversify your investments and avoid putting all your eggs in one basket.

-

Stay Disciplined:

Trading in the CWG market can be emotional and stressful, especially when things don’t go as planned. It’s crucial to stay disciplined and stick to your trading plan, even when the market gets volatile. Avoid making impulsive decisions and let your strategy guide your trading decisions.

-

Learn from Your Mistakes:

Every trader makes mistakes, but the key is to learn from them and improve your trading strategy. Take the time to review your trades and analyze what went wrong. By learning from your mistakes, you can become a more successful trader and refine your trading strategy over time.

Conclusion

Navigating the CWG market for trading can be challenging, but with the right strategies and mindset, you can trade successfully. By staying informed, setting clear goals, diversifying your portfolio, using technical analysis, managing your risk, staying disciplined, and learning from your mistakes, you can become a more effective trader and achieve your trading goals.