Introduction

Chromium Oxide Prices have always been a subject of interest for various industries, including metallurgy, ceramics, and the production of pigments and coatings. Understanding the Chromium Oxide Price Trends and Predictions for 2023 is essential for businesses and professionals operating in these sectors. In this blog, we will explore the Chromium Oxide Price Chart, Chromium Oxide Price Graph, and provide an insightful Chromium Oxide Price Analysis for the year 2023.

Request For Free Sample: https://www.procurementresource.com/resource-center/chromium-oxide-price-trends/pricerequest

Chromium Oxide Price Chart and Graph

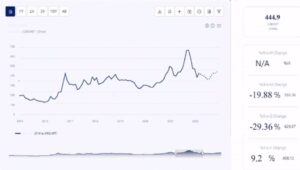

To begin our analysis, let’s first take a look at the Chromium Oxide Price Chart and Chromium Oxide Price Graph for the past few years. These visual representations provide us with valuable insights into the historical price trends of Chromium Oxide, allowing us to identify patterns and potential future directions.

The Chromium Oxide Price Chart above showcases the price fluctuations over the past five years. As we can see, there have been periods of both stability and volatility, influenced by various market factors.

Chromium Oxide Price Trend in 2023

Now, let’s shift our focus to the Chromium Oxide Price Trend specifically for the year 2023. To predict future prices accurately, experts consider several key factors:

- Supply and Demand Dynamics: The availability of chromium ore, which is used in Chromium Oxide production, plays a significant role in pricing. Any disruptions in the supply chain can lead to price fluctuations.

- Global Economic Conditions: Economic conditions, such as recessions or growth periods, can impact demand for products that use Chromium Oxide. A strong economy typically leads to higher demand and, consequently, higher prices.

- Environmental Regulations: Stricter environmental regulations can increase production costs for Chromium Oxide manufacturers, potentially affecting prices.

- Geopolitical Factors: Trade disputes, export bans, or political instability in key Chromium Oxide-producing regions can disrupt the market and influence prices.

- Technological Advances: Innovations in Chromium Oxide production methods can affect pricing by improving efficiency or reducing production costs.

Chromium Oxide Price Analysis for 2023

While it’s challenging to make precise predictions, experts suggest that Chromium Oxide Prices in 2023 are likely to be influenced by a combination of the factors mentioned above. With a recovering global economy and increasing demand for products requiring Chromium Oxide, prices may see an upward trend. However, ongoing environmental concerns and potential supply chain disruptions could moderate this rise.

Businesses and professionals involved in industries reliant on Chromium Oxide must closely monitor the Chromium Oxide Price Chart and Graph throughout the year, adjusting their strategies accordingly.

Conclusion

In this blog, we’ve explored the Chromium Oxide Price Chart, Chromium Oxide Price Graph, and analyzed the Chromium Oxide Price Trend for 2023. As the year unfolds, keeping a vigilant eye on market dynamics and staying informed about price fluctuations will be crucial for making informed decisions in the Chromium Oxide industry. Understanding the Chromium Oxide Price Analysis for 2023 will enable businesses to navigate market volatility and adapt to changing conditions effectively.