In the Asia Pacific region, phosphorus pentachloride prices were hindered by Lunar holidays, reduced electric vehicle demand, and uncertain market conditions in Q1. Feeble support from upstream industries and battery manufacturing decline further impacted the trend negatively. However, Q2 saw a less significant dip as feedstock costs decreased and demand increased in electric devices. In Europe, the ongoing Russia-Ukraine crisis caused energy cost spikes, leading to inflation and weak dye manufacturing demand, resulting in a decline. Q2 saw a slow recovery marked by low Asian exports and increased Russian imports, intensifying competition. North America experienced Q1 price drops due to sluggish markets and electric vehicle sales, while Q2’s rising electric vehicle sales increased competition, inhibiting pentachloride price growth.

Request for Real-Time Phosphorus Pentachloride Prices: https://www.procurementresource.com/resource-center/phosphorous-pentachloride-price-trends/pricerequest

Definition

Phosphorus pentachloride (PCl5) is a chemical compound consisting of phosphorus and chlorine atoms. It appears as a yellowish-white solid or colorless liquid. With a molecular formula of PCl5, it is widely used in chemical synthesis as a chlorinating agent, converting hydroxyl groups in organic compounds to chlorides. PCl5 is highly reactive due to its tendency to release chlorine gas upon exposure to moisture. It is employed in various industries for manufacturing pharmaceuticals, agrochemicals, and other organic compounds.

Key Details About the Phosphorus Pentachloride Price Trend:

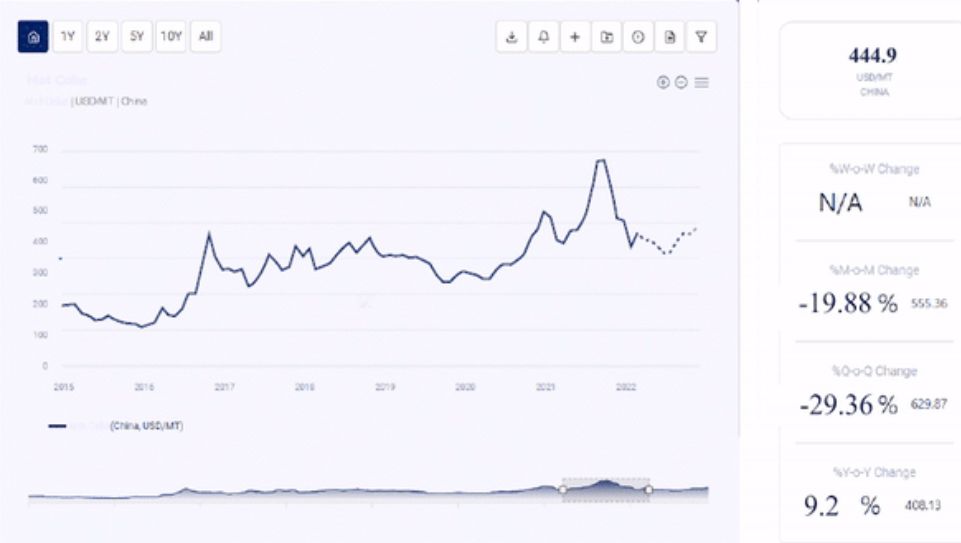

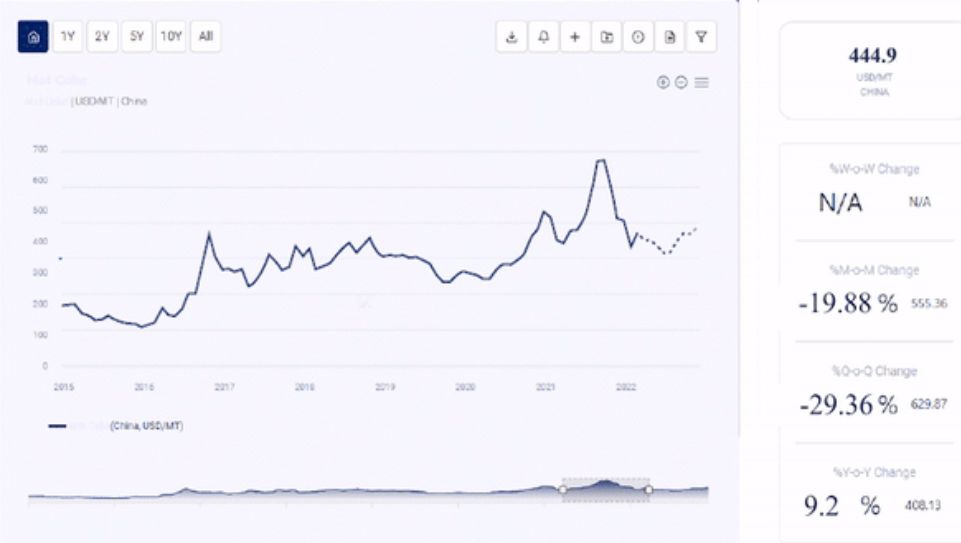

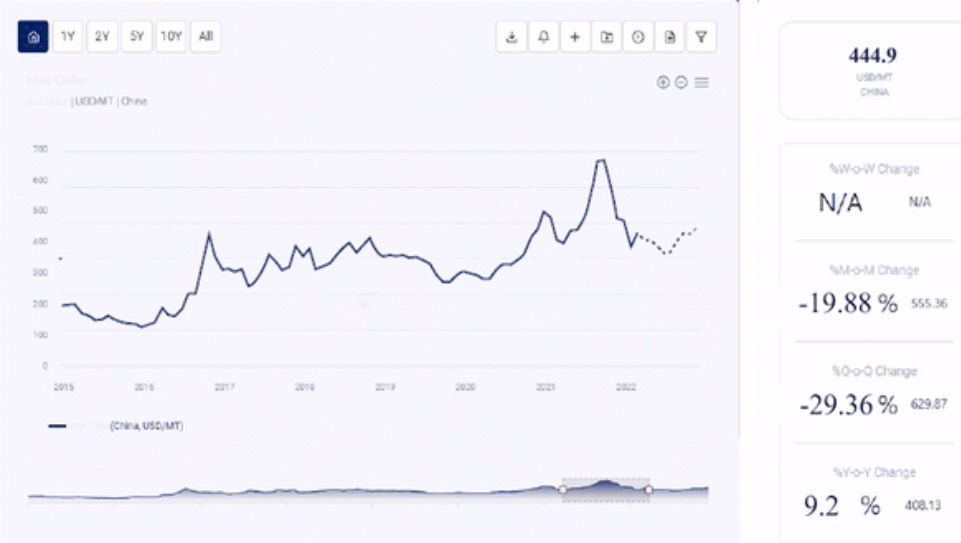

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on Phosphorus Pentachloride in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as Excel files that can be used offline.

The Phosphorus Pentachloride Price Trend, including India Phosphorus Pentachloride price, USA Phosphorus Pentachloride price, pricing database, and analysis can prove valuable for procurement managers, directors, and decision-makers to build up their strongly backed-up strategic insights to attain progress and profitability in the business.

Industrial Uses Impacting the Phosphorus Pentachloride Price Trend:

Phosphorus pentachloride (PCl5) is extensively utilized in various industrial applications. Its strong chlorinating properties make it a vital reagent in chemical synthesis, converting hydroxyl groups into chlorides, which is crucial in pharmaceutical and agrochemical production. PCl5 is instrumental in the creation of dyes, pigments, and specialty chemicals. It plays a pivotal role in manufacturing flame retardants, plasticizers, and other important compounds. Furthermore, PCl5 serves as a powerful chlorinating agent in the rubber and plastics industry, modifying material properties. Its role in gas purification, particularly in removing impurities from natural gas, further highlights its versatile utility in industries ranging from chemicals to energy.

Phosphorus pentachloride (PCl5) is extensively utilized in various industrial applications. Its strong chlorinating properties make it a vital reagent in chemical synthesis, converting hydroxyl groups into chlorides, which is crucial in pharmaceutical and agrochemical production. PCl5 is instrumental in the creation of dyes, pigments, and specialty chemicals. It plays a pivotal role in manufacturing flame retardants, plasticizers, and other important compounds. Furthermore, PCl5 serves as a powerful chlorinating agent in the rubber and plastics industry, modifying material properties. Its role in gas purification, particularly in removing impurities from natural gas, further highlights its versatile utility in industries ranging from chemicals to energy.

Key Players:

- Xuzhou Weiruipu Chemical

- Huaian Huayuan Chemical

- Hantech Chemical Co Ltd

- Vital Chemicals

- Italamtcj Chemicals

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and most up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team tracks the prices and production costs of a wide variety of goods and commodities, hence providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients with up-to-date and pioneering practices in the industry to understand procurement methods, supply chains, and industry trends so that they can build strategies to achieve maximum growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Amanda Williams

Email: sales@procurementresource.com

Toll Free Number: USA & Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Reference Link – https://theprocurementexpert.com/phosphorus-pentachloride-prices/

Aluminum Fluoride is extensively used across industries. In metallurgy, it serves as a crucial flux in the production of aluminum, aiding in the electrolytic reduction of aluminum oxide. In glaze applications, it enhances ceramic surfaces, providing color, gloss, and durability. Additionally, it finds utility in the glass industry as a refining agent to remove impurities and enhance transparency. Its role extends to the production of aluminum-based chemicals and as a catalyst in various chemical processes. The diverse applications of Aluminum Fluoride highlight its significance in metallurgical, ceramics, glass, and chemical sectors.

Aluminum Fluoride is extensively used across industries. In metallurgy, it serves as a crucial flux in the production of aluminum, aiding in the electrolytic reduction of aluminum oxide. In glaze applications, it enhances ceramic surfaces, providing color, gloss, and durability. Additionally, it finds utility in the glass industry as a refining agent to remove impurities and enhance transparency. Its role extends to the production of aluminum-based chemicals and as a catalyst in various chemical processes. The diverse applications of Aluminum Fluoride highlight its significance in metallurgical, ceramics, glass, and chemical sectors. Ampicillin, a broad-spectrum antibiotic, finds significant industrial application in biotechnology and pharmaceutical sectors. It is utilized in the production of recombinant proteins and therapeutic enzymes due to its ability to hinder bacterial contamination. Ampicillin’s role in molecular biology involves its inclusion in growth media for the selection of transformed bacterial cells carrying plasmids with the ampicillin resistance gene. This allows for efficient isolation of genetically modified organisms. Additionally, ampicillin plays a crucial role in research laboratories as a selective agent in microbiology experiments. Its diverse industrial uses underscore its importance in maintaining sterility and manipulating genetic materials for various applications.

Ampicillin, a broad-spectrum antibiotic, finds significant industrial application in biotechnology and pharmaceutical sectors. It is utilized in the production of recombinant proteins and therapeutic enzymes due to its ability to hinder bacterial contamination. Ampicillin’s role in molecular biology involves its inclusion in growth media for the selection of transformed bacterial cells carrying plasmids with the ampicillin resistance gene. This allows for efficient isolation of genetically modified organisms. Additionally, ampicillin plays a crucial role in research laboratories as a selective agent in microbiology experiments. Its diverse industrial uses underscore its importance in maintaining sterility and manipulating genetic materials for various applications.