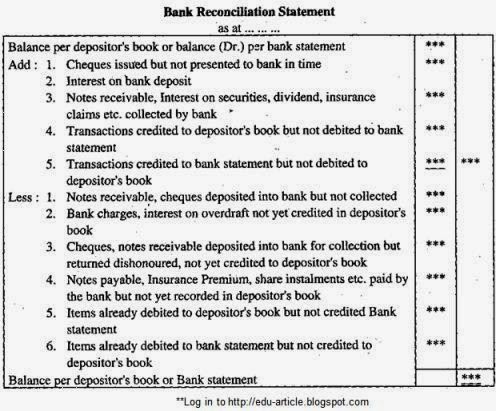

The next step is to identify any discrepancies between these two sets of records, which could be due to errors, omitted entries, or timing differences in recognizing transactions. Once these discrepancies are identified, they need to be thoroughly investigated. For instance, if a check issued by the company has not been cashed, it would show up in the company’s records but not on the bank statement. If the two amounts do not agree, compare each card payment and credit in QuickBooks to the statement to make sure you have all the cleared transactions checked off. You can reconcile to the credit card statement, or you can reconcile to the balance at month end per the history in online banking.

Reviewing past reconciliations

As you work through the process, ensure that the beginning balance, transactions, and ending balance match the corresponding values on your credit card statement. By following these steps, you can successfully reconcile your credit card in QuickBooks. Troubleshooting reconciliation issues in QuickBooks demands a careful and methodical approach.

Identifying errors in your reconciliation

This guide will teach you how to reconcile credit card accounts in QuickBooks Online to ensure that the credit card activity in the platform matches your credit card statements. We’ll also share some of the common errors that you may encounter, along with some tips to locate discrepancies. Then, compare each transaction to its counterpart in the credit card statement, ensuring that they align accurately.

Can You Pay Bill Me Later From a PayPal Balance?

To reconcile your account, review your transactions and trace them in both directions—from your books to your credit card statement, and from your credit card statement back to your books. NerdWallet’s accounting software ratings favor products that are easy to use, reasonably priced, have a robust feature set and can grow with your business. The best accounting software received top marks when evaluated across 10 categories and more than 30 subcategories.

- In cases where an opening balance wasn’t entered previously, QuickBooks Online provides the option to add it retrospectively.

- After entering all your statement information, click the green Start reconciling button.

- To see all of your adjustments on the list, you can review a Previous Reconciliation report for the reconciliation you adjusted.

- Sometimes, this ease of use can cause you to make an error that results in having to undo the reconciliation.

- Now, it’s time to look for any transactions on your statement that do not contain a mark next to them.

- Ensure that the balance in QuickBooks Online matches the balance on your credit card statement to complete the reconciliation process effectively.

Upon completing the reconciliation process, the cleared balance should match the statement ending balance, resulting in a difference of zero. If there’s a transaction on your statement that isn’t in QuickBooks but the transaction is correct, then you need to add it to QuickBooks. In our sample credit card statement, you’ll notice that the transaction for Michael Kretchmar for the amount of $300 isn’t recorded in QuickBooks.

Retrieving a Voided Transaction in QuickBooks

Reporting capabilities increase with each plan, but even the least expensive Simple Start plan includes more than 50 reports. Our research team has crunched the numbers, testing eight software brands across eight research subcategories to confirm that QuickBooks offers the best service with a top overall score of 4.7/5 points. QuickBooks has the best payroll software as well, although we offer a quick quiz that can pair you with all the top payroll options for your industry. If you’d like to try other great accounting software, we have you covered as well, with deals on FreshBooks, Xero, and others. QuickBooks Online stands as the best accounting software that our researchers have tested, due to a great feature catalog, reporting tools, a top-quality support team, and a customizable interface. Feel free to let me know if you need further assistance with reconciling your credit card transactions.

Additionally, you don’t need to create a credit card liability because a credit card inherently represents a liability on its own. When you’re finished setting up your payment or have decided to wait until later, hit the green Done ace the investment banking interview financial statements question button (not shown in the image above). When your reconciliation is complete, click the green Finish now button in the upper-right corner of the screen. Before you start with reconciliation, make sure to back up your company file.

Any disparities should be investigated and resolved to maintain balance and ensure the financial accuracy of the records. By following these steps, users can effectively https://www.online-accounting.net/ reconcile discrepancies within the online platform. This process is essential for maintaining financial integrity and a clear understanding of a business’s cash flow.

Schedule reports to be generated and emailed daily, weekly, or monthly. Ensure that all the details—including the dates, amounts, and descriptions—match your credit card statement. To do this, right-click on the reconciliation screen’s tab in your internet browser and select “duplicate” to open a second tab. Once the changes are saved, you’ll need to refresh the original tab to see the updated screen.

Select the appropriate bank or credit card account to reconcile from the Account field. Ensure that the Statement Date in QuickBooks Desktop corresponds with your actual bank statement, making adjustments as needed. QuickBooks Desktop will automatically generate a Beginning Balance based on your last reconciliation. For accounts connected to online banking, confirm that all transactions are accurately matched and categorized. To access the reconciliation tool in QuickBooks Online, navigate to Settings and then select Reconcile. Finally, after identifying and resolving these discrepancies, adjustments are made to the financial statements to reflect the reconciled balance, ensuring accuracy and consistency in the financial records.

To reconcile, simply compare the list of transactions on your bank statement with what’s in QuickBooks. Yes, you can follow the suggestion above by creating a journal entry to record the business expense. Then, proceed with the process of reconciliation without creating a check. Can https://www.accountingcoaching.online/bad-debt-reserve-accountingtools/ I still do the first step and then reconcile the credit card statement? I wanted to ensure you’re able to reconcile your credit card account accordingly. Additionally, to keep your downloaded bank feed transactions in QuickBooks are accurate, please ensure to add and match them.

If you want to reconcile in QuickBooks Desktop, this guide provides a detailed, step-by-step approach to help you through this process. Additionally, you can pay your credit card bill directly or add any other bills. You’ll also notice on the screen that there’s a Modify button, which allows you to change the amounts you entered in Step 1. Annual subscriptions are expensive; each additional user license and cloud access costs extra. Phone and chat support, plus a dedicated account representative in all plans.