The payment of accounts receivable can be protected either by a letter of credit or by Trade Credit Insurance. The accounts receivable team is in charge of receiving funds on behalf of a company and applying it toward their current pending balances. Collections and cashiering teams are part of the accounts receivable department. While the collections department seeks the debtor, the cashiering team applies the monies received. Businesses aim to collect all outstanding invoices before they become overdue.

Understanding Accounts Receivable (AR)

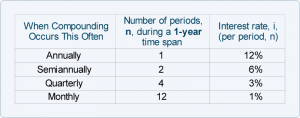

A low CEI can suggest that manual invoicing, rigid payment terms, or communication challenges are hindering a business’ invoice-to-cash process. Day sales outstanding (DSO) is the average number of days it takes for a company to receive payment after making a sale on credit. DSO is also known as “average collection period” or “days receivable.” DSO measures how long it takes a company to receive payment. Before moving processes online https://www.business-accounting.net/technical-analysis-for-dummies-3rd-edition-by/ and automating tasks, it’s essential to understand your organization’s entire accounts receivable process to gauge areas for improvement. Accounts receivable automation brings accuracy, efficiency, and key advantages to businesses across sectors. Whether a business is looking for faster billing, stronger compliance, or more insightful analytics, automation serves as an effective solution for managing accounts receivable complexities.

What are the Benefits of Optimizing your Accounts Receivable Processes?

This is to ensure that any payments that are owed to a business are collected on time. They also make sure that the payments are made in their entirety and credited to the correct account. Accounts receivable, or AR, is the balance of money due to a business for goods or services delivered or used, but not paid for yet by the buyer.

Get Weekly 5-Minute Business Advice

Sometimes it might be the right move for your company to outsource AR but ask yourself if you are doing it for the right reasons. If you are outsourcing only because of the operations of AR then this is a mistake. Instead, opt for using specialized AR software that will keep this process internal and will do most of the heavy lifting of the collection process thanks to automation. Keeping AR internally ensures you are adding value to your customer relations, and you are sending invoices and reminders at appropriate times and to the right points of contact. External AR management simply does not have the insights that you have in your own business and will likely fail at providing the right service and keeping good relations with your customers. Outsourcing accounts receivable also makes it harder to facilitate communication among your teams to keep everyone in the loop about their clients.

How Highradius Can Help You Manage Your Accounts Receivable?

- This approach offers direct financial benefits in addition to supporting a business’s long-term health and reputation.

- The absence of a unified data system and information silos creates obstacles to effective collaboration.

- Now that we have cleared that up, follow these 8 tips to improve your receivables management and make payment collection effortless and efficient.

- Information is gathered on a regular basis and reviewed by our editorial team for consistency and accuracy.

Consider adopting a payment portal that allows you to structurally communicate all the information your customers need in one go (amount due and method of payment). Electronic billing and payment systems can help centralize and resolve invoicing and payment matters with your clients. For example, you can set automatic follow-ups with clients the first day a payment is late, then once each week until the account is settled. This is why having a controlled grip on your accounts receivable management is seen as such a vital component of running a business.

We’ve served to more than 5000 clients spread around the globe, among which there are LG, PWC, HP, EY, Deloitte, Barclays, Rothschild, inspiring us each day to be the best in the market. With over 1200 professionals in 12 countries, we are one of the world’s largest teams of e-commerce experts. Top brands like Adidas, Puma, Versace, Jimmy Choo, Tommy Hilfiger, Hugo Boss, and Crocs are among our clients.

Then divide that by the sum of beginning receivables and monthly credit sales, minus ending current receivables. This creates more account management work for AR teams and a negative customer experience. Fifty-five percent of AR professionals say dispute management is their most difficult task. Making this AR management process easier can improve both employee happiness and resource management internally, and customer experience on the external side. Furthermore, the Allowance for Doubtful Accounts is recorded as a Contra Account with Accounts Receivable on your company’s balance sheet. According to the above example, a customer on an average takes 65 days to pay for the goods purchased on credit for Ace Paper Mills.

With QuickBooks Enterprise, business owners can set up volume discounts and customize pricing rules according to sales rep, item category or customer in the Platinum plan and up. The same plans help speed up the inventory count process by allowing businesses to use mobile devices as barcode scanners. And unlike some competitors that only track single inventory items, QuickBooks Enterprise lets you track inventory parts plus assemblies. You can also track the cost of goods sold and adjust inventory for loss or shrinkage.

However, the process of maintaining and collecting payments on the accounts receivable subsidiary account balances can be a full-time task. Depending on the industry in practice, accounts receivable payments can be received up to 10–15 days after the due date has been reached. These types of payment practices are sometimes developed by industry standards, corporate the causes of depreciation policy, or because of the financial condition of the client. Credit cards, cash, and paper checks are no longer the only forms of customer payment. More payment methods can reduce late payments and foster a healthy cash flow. The convenience of choosing a preferred payment option takes less work for your customers than if they tried to fit a specific method.

Accounts receivable automation alone cannot drive significant change if existing processes are flawed–but it’s certainly a great place to start. Companies may need to redesign their AR processes to ensure optimal success. From there, they should automate every step possible to fully realize the benefits of AR transformation. Providing multiple payment options https://www.quick-bookkeeping.net/ allows customers to remit with their choice method, giving them fewer excuses for failing to pay. It is best practice for a business to be discrete about which customers they will extend credit terms to when drafting a credit policy. To calculate CEI, add your beginning receivables and monthly credit sales, then subtract ending total receivables.

Using EMS, Accounts Receivable staff can assess credit risk in real-time and design limits to adjust automatically. They can leverage intelligent credit limit suggestions and access all relevant data in a single place, while using automation to accelerate the approval process. An EMS can pull data from across your underlying systems, including your accounting software, as well as integrate third-party and custom data from standard credit bureaus and a company’s own scorecards. Accounts receivable represents money owed by entities to the firm on the sale of products or services on credit. For any business that sells goods or services on credit, effective accounts receivable management is critical for cash flow and profitability planning and for the long-term viability of the company.